There are a wide range of different payment cards so it is quite understandable to be confused and not know the difference between them and where they can be used. Hopefully this post will get rid of any confusion by explaining what each card is and what it is used for.

Debit Card

This is a card that can be used to spend money that you already have. It is linked to a current bank account and enables you to withdraw money from a cash machine or use it to pay for goods and services. Some shops will allow you to use it to get cashback which means you can withdraw cash at the same time as paying for items. These cards are now contactless, which means you don't have to insert your card into the card reader and put in your PIN, instead all you have to do is tap your card on the machine to pay for goods up to the value of £100. Paying by debit card will only allow you to spend as much money as you have in your account unless, if you're over the age of 18, you have applied for an overdraft, then you can withdraw more money than you have in your account. You need to remember that you may be charged interest or get bank charges if you go over the agreed limit.

Credit Card

These can be used to pay for goods and services even if you don't have enough money in your account. If you don't pay the money back within an agreed time you will have to pay interest with late or missing payments affecting your credit score (we will explain more about credit scores and how they affect your finances in an upcoming post). If you use your credit card to withdraw cash from a cash machine you will automatically be charged interest and a handling fee. Credit cards. aren't automatically handed out you need to apply for one, be over the age of 18 and pass credit scoring.

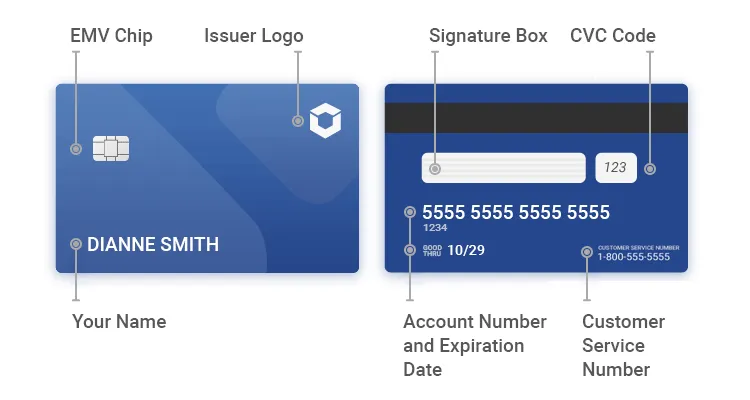

How to understand the information on a credit/debit card

A physical credit or debit card has information on it that identifies both the card holder and the card issuer.

Issuers logo - this may appear on either the front or the back of the card.

Payment network logo - though your card is issued by one specific bank all charges on it are processed by one of the four major payment networks. This means that you'll see a logo from American Express, Visa, Discover or Mastercard on the front or back of the card.

EMV chip - this is found on the front of the card. It stores encrypted card data which allows you to make purchases more securely

Contactless symbol -Credit and debit cards use short-range wireless technology to tap your card on a card reader instead of inserting and typing in the PIN. The symbol looks similar to a Wi-Fi symbol.

Magnetic strip – this can be found on the back of your card and stores your card information though it’s not as secure as the EMV chip.

Your name and account number: - your name will appear on the front or back of the card, as well as your account number. Your name on your card will be exactly as you filled it in on your application form.

Expiration date: - this tells you the month and year when your card is no longer usable. Before this date, your card issuer will send you a new card, usually about a month before it expires. This date be on the front or back of the card.

CVC code -: this is short for card verification value, it'll be a three-digit number on the back of the card if you have a Discover, Mastercard or Visa card. If you have an American Express card, it's a four-digit number on the front of the card.

Customer service phone number: - the card issuer provides a customer service number on the back of the credit card, which you can call if you have questions or a problem to resolve.

Signature box -: cards have a strip where cardholders are expected to sign their name. There can be the risk of shops not accepting the card for payment if the strip hasn’t been signed and won’t accept it if the signature is done in front of them.

Pre-Payment Bank Cards

You don't always need a bank account for this type of card as money is put onto a card to pay for goods and services. This card can be used by anyone over the age of 6 with the money being added by an adult in advance. Once the money on the card has been spent it's gone

Digital Wallet

You can use this to pay for goods and services online and in every store that accepts contactless payments. In order to be able to use Apple Pay you have to be 13 yrs old and 16 yrs old to use Google Pay. s type of payment is linked to your debit or edit card. his is a safe way to pay as they use data encryption and authentication to protect your personal information.