Tax is a compulsory additional payment you make to the government and can be in a number of different ways, ranging from an additional cost on a product to an amount taken from business profits or an individual’s wage. The money raised from taxes goes straight to the UK Government.

The Government decides how much tax that businesses and members of the public have to pay. These rates are typically reviewed every year and very rarely increase or decrease by large amounts. You will pay tax on your income, on products and services that you buy and even on your house, when you buy it. Virtually everything that you purchase will have one form of tax or another linked to it. The only exception are essential items, like most food and drink, as long as it is alcohol free.

What different forms of tax are there?

You will pay tax on virtually everything. These are the common types of tax.

Income Tax

This is a tax that is paid on any income, which, for most people takes the form of money that they earn. If you are employed by a company this tax gets deducted from your weekly or monthly income before it gets paid into your bank account, we looked at this in more detail in a previous post. If you are self-employed, then you have to submit your own income tax using an HMRC self-assessment form. This type of tax isn’t just restricted to money that you earn from a job. If you own houses that you rent out or have money invested, you will have to pay income tax on any profit that you make. Also, if you have savings and the interest that you receive from it exceeds the personal allowance threshold you will have to pay income tax on it.

VAT

This stands for Value Added Tax and is set at 20% for most products and services. Whether you’re a business or an individual VAT will have been added to purchases from stationary to taxis.

There are some items where a reduced rate of 5% is applied, these include some health products, fuel, heating and car seats for children. There is a 0% rate added to essential items which include most food, books and clothes for children.

Road Tax

This is also known as Vehicle Excise Duty. It is an amount based on your car emissions that you have to pay to be able to drive your car on the public road.

Stamp duty

This it a tax which you pay when you buy a house. This is charged at different rates depending on the price of the property. You don’t have to pay any tax on the first £250,000 of a property. So if you purchased a house for £245,000 you wouldn’t have to pay any stamp duty. First time buyers can claim a discount on this so don’t have to pay any stamp duty for the first £425,000 paid for a property.

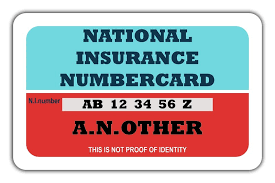

National Insurance

This is another type of income tax which we looked at in an earlier post.

Excise duty.

This is an indirect tax applied to the sale or use of products such as fuel, alcohol and tobacco. These duties can often be high to try to persuade people not to use or buy them.

Capital Tax or Capital Gains Tax

This is a tax that has to be paid on the profit an investor makes when an investment is sold. Capital gains taxes apply only to capital assets, these include stocks, bonds, digital assets like cryptocurrencies and NFTs, jewellery, coin collections, and real estate. The selling of residential property doesn’t come under this.

Corporation Tax.

This is a tax that all limited companies must pay on their profits once overheads and expenses have been deducted. This applies to UK resident companies and branches of overseas companies.

The image below shows the amount raised by the Government in one year through these, and other, taxes in 2023-24.

https://view.genial.ly/657c6ee56ce2de001464a683/interactive-image-how-the-government-raises-revenue

What are these tax payments used for by the Government?

The money raised from taxes goes to pay for essential products and services. Schools, emergency services, roads and healthcare are some of the major things we benefit from by paying taxes. Money raised through taxes also goes to people who need extra support for a wide variety of reasons, such as disability or those who are carers, both in the UK and abroad.

The image below shows the things that the money was spent on, including the amount during 2023-24.

https://view.genial.ly/657c772cdbd71a00147b3602/interactive-image-where-the-revenue-raised-by-taxes-is-spent-by-the-government